Risk assessment from day-ahead electricity price volatility

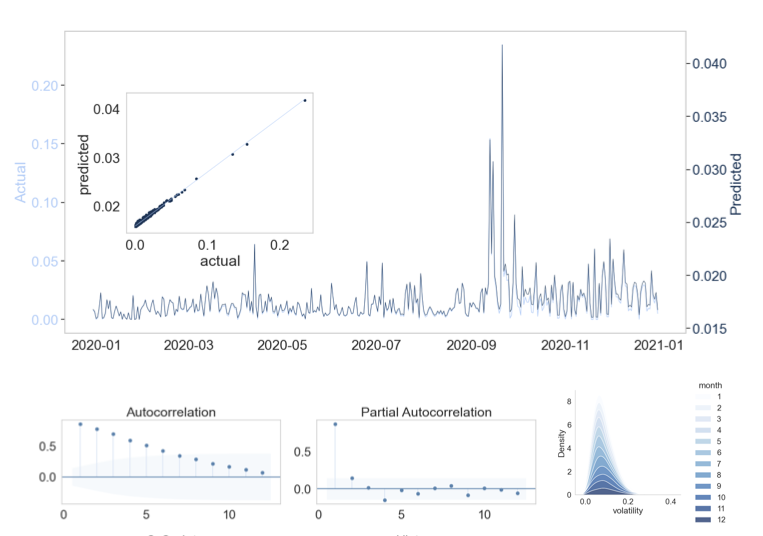

The presence of unusually large spikes in electricity prices in the day-ahead market causes risks for all market players and induces skepticism among investors. To hedge against their inherent risks, proper understanding of the price dynamics is required with accurate model forecasts. In this work the nature of volatility associated with the day-ahead electricity prices in west and east Denmark of NordPool power market has been empirically studied. Danish power system is undergoing rapid changes to promote green energy transition via multiple attempts including overall energy demand by improving system efficiency, largely encouraging grid integration of clean energies and phasing out of several central power plants. All these attempts have significantly influenced the changes in electricity price dynamics in Danish markets. In this study, the changes in high and low price periods over the years have been investigated in lights of increasing variable renewable shares and the response from the rest of the system. Additionally, the daily logarithmic volatility is analyzed over different time scales and thereby separating its trend and seasonality components. Finally, a HAR-RV model is developed and implemented to predict daily realized variance of the following day.